OAKBROOK TERRACE – To increase microchip production and attract companies to invest in Illinois, State Senator Suzy Glowiak Hilton (D-Western Springs) championed a new law to create a series of tax credits to support the semiconductor industry.

OAKBROOK TERRACE – To increase microchip production and attract companies to invest in Illinois, State Senator Suzy Glowiak Hilton (D-Western Springs) championed a new law to create a series of tax credits to support the semiconductor industry.

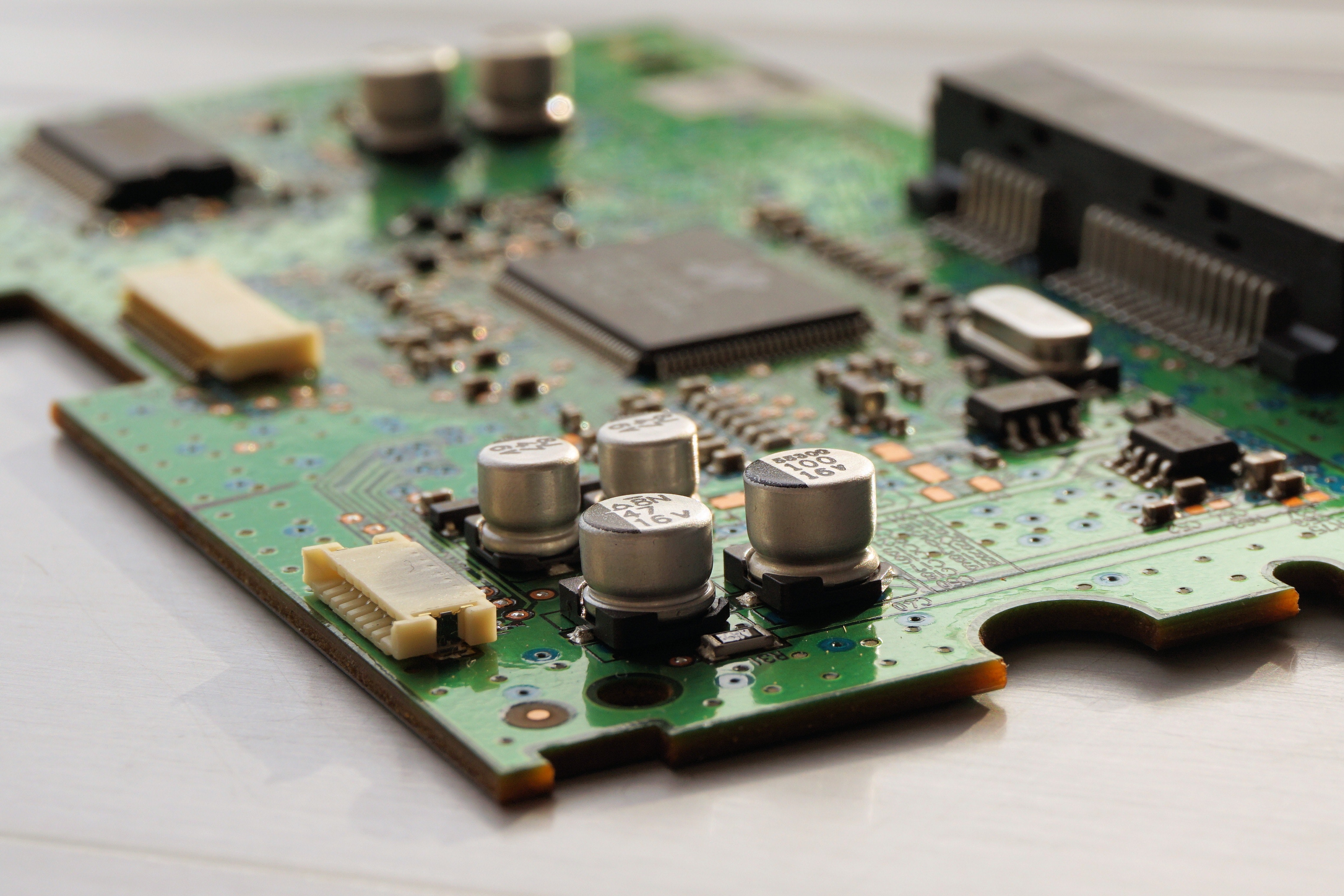

“The U.S. relies on microchip imports to fulfill local manufacturing needs,” said Glowiak Hilton, chair of the Senate Commerce Committee. “In response to the national semiconductor supply chain shortage, we can use this opportunity to serve local production, build the industry in Illinois and create job opportunities for residents.”

Nationally, the semiconductor supply chain has been fragile for years and has hindered manufacturing across the United States. For added economic security, Glowiak Hilton’s measure incentivizes bringing chip manufacturing back to local production.

Under Glowiak Hilton’s initiative, the Manufacturing Illinois Chips for Real Opportunity Act provides a range of tax credits for semiconductor, microchip and component part manufacturers to support new employee training and encourage companies to develop operations in underserved communities. The proposal was included in the General Assembly’s final tax relief plan expanded in Senate Bill 157.

In addition to creating the MICRO Act, the tax relief plan also increases the tax credit for teachers buying classroom materials from $250 to $500, implements a tax holiday for back-to-school shopping from Aug. 5 to Aug. 14 of this year, and allows sales tax exemptions for breast pumps and supplies.

“The pandemic has created numerous financial burdens for members in our communities,” Glowiak Hilton said. “With this plan, Illinois is offering support to the individuals who have kept our state operational during some of the toughest times.”

Senate Bill 157 is effective immediately.